Flood Zones, Wind Mitigation & Insurance: Pricing a Florida Home the NY Way

A step-by-step guide to reading flood maps, roof age/shape, wind-mit credits—and how these change your “true monthly” vs. a NYC mortgage + HOA

New Yorkers are pros at comparing mortgage + HOA/common charges. In Florida, you’ll still do that—but you’ll also price wind/hurricane insurance, flood risk, roof age/shape, and mitigation credits. Get those right, and you’ll avoid surprises and negotiate smarter.

Below is a practical, step-by-step playbook you can use for any Tampa Bay (or Florida) property.

Step 1 — Pull the Flood Zone (and what it actually means)

Find the FEMA Flood Zone (AE, VE, X, etc.).

X (minimal/moderate risk): Flood insurance often optional for lenders; still consider a low-cost policy.

AE/VE (higher risk): Lenders usually require flood insurance (VE adds wave action).

Ask for the Elevation Certificate (EC) if the home is in AE/VE.

The EC shows Base Flood Elevation (BFE) vs. first finished floor. The higher the floor sits above BFE, the better your flood premium typically gets.

Estimate premium pathways:

NFIP (standardized program) vs. private flood (market-priced). Sometimes private flood is cheaper or allows higher coverage—price both.

NYC vs. FL translation: In NYC co-ops/condos, you rarely buy a separate flood policy personally. In Florida single-family or low-rise condos/townhomes, you often do—so it belongs in your monthly.

Step 2 — Roof Reality Check (age, shape, materials)

Insurers in Florida care—a lot—about roofs.

Age:

Composition shingles: many carriers want ≤ 15 years (some allow more with proof of condition).

Metal/tile: often longer useful life, better with mitigation.

Shape:

Hip roofs (sloped on all sides) typically earn wind credits.

Gable roofs may cost more unless bracing is present.

Condition & permits:

Ask for roof permit history, photos, invoices, and any secondary water barrier paperwork.

Action item: If the roof is near an insurer cutoff, price a replacement now—then subtract likely wind-premium savings to know your real ROI.

Step 3 — Order the Right Inspections (they save you real money)

Wind Mitigation Inspection (Uniform Mitigation Verification, often called the “wind-mit”):

Documents roof-to-wall connections (clips/straps), roof deck attachment, roof shape, secondary water barrier, impact-rated coverings (windows/doors), or shutters.

Each item can unlock premium credits on your homeowners policy.

4-Point Inspection (older homes):

Reviews Roof, Electrical, Plumbing, HVAC—required by many carriers for homes ~20+ years old.

For condos:

Unit owners buy HO-6 (“walls-in”) policies. Confirm the building’s master policy, wind deductible, and whether the association already completed wind-mit upgrades (impact glass, roof).

Pro tip: Ask the seller to provide a recent wind-mit report; it’s inexpensive and often pays for itself in year one.

Step 4 — Price the Homeowners Insurance (wind/hurricane included)

When you request quotes, give agents all the info above (flood zone, EC, wind-mit, roof age/shape). Ask for:

Dwelling limit that matches replacement cost,

Hurricane deductible (commonly 2% of dwelling limit—know this number in dollars),

Ordinance & Law coverage (code upgrades),

Water backup if relevant,

Loss Assessment (condos/HOAs).

Compare two to three carriers—admitted and, where appropriate, E&S (surplus lines). Tie the quote to your exact address + mitigation so it’s apples-to-apples.

Step 5 — Compute Your “True Monthly” (Florida-correct)

Use this simple formula:

True Monthly =

Principal & Interest (your loan)

Property Taxes (divide annual by 12; apply Homestead if primary)

Homeowners Insurance (wind/hurricane)

Flood Insurance (if any)

HOA/Condo Dues (and CDD if it applies)

Average Utilities (optional but smart)

NYC vs. FL: In NYC you likely used Mortgage + HOA/Common + Taxes (escrowed). In FL, add wind and flood explicitly—and know your hurricane deductible exposure.

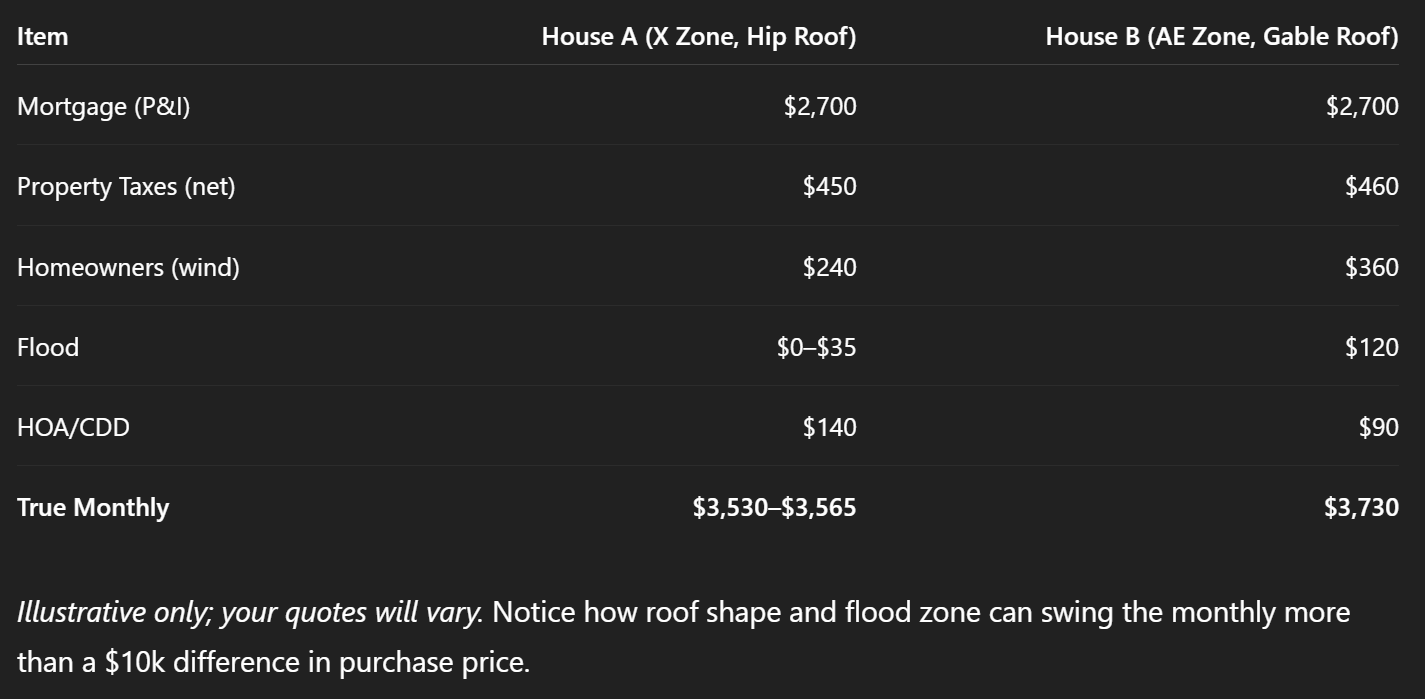

Step 6 — Model Two Addresses Side-by-Side (to avoid surprises)

Create a quick matrix:

Step 7 — Negotiate with Numbers (credits, concessions, timing)

If flood elevates premium: Ask for seller concession toward first-year flood or private flood shopping period in escrow.

If roof age hurts: Request a price reduction or credit for roof work; many buyers recoup the difference in lower premiums.

If wind-mit is favorable: Keep the report in your file and share with your insurer for credits.

Step 8 — Condo Buyers: Master Policy & Budget Deep-Dive

Master policy: Check coverage limits, wind deductible (%), and special assessment history.

SIRS & reserves (3-story+): Ensure structural reserves are funded—underfunded reserves can drive dues up later (your monthly).

Rental rules: If you plan to rent seasonally, confirm minimum lease terms and caps before you offer.

Step 9 — New Construction vs. Resale (different risk profiles)

New builds often come with lower wind premiums (new codes, hip roofs, clips/straps). Flood depends on site elevation and map.

Resales can be great—but price the roof age, panel type (electrical), plumbing (polybutylene?), and mitigation gaps.

Step 10 — Think in “Exposure,” Not Just “Payment”

Two houses with the same monthly can have very different risk:

A home with impact glass + hip roof + SWB (secondary water barrier) might weather storms better and rebound faster after events, even if the premium is similar.

A home in AE with an EC showing finished floor below BFE can be costlier to insure and riskier in extreme events—unless elevated or mitigated.

Quick Buyer Checklist (print this)

☐ FEMA Flood Zone + Elevation Certificate (if AE/VE)

☐ Wind-Mit & 4-Point inspections (or recent copies)

☐ Roof age, shape, permits, and material

☐ Homeowners and Flood quotes (2–3 each if possible)

☐ If condo: master policy, wind deductible, SIRS/reserves, minutes, special assessments

☐ Compute True Monthly using the formula above

☐ Price hurricane deductible (2% of dwelling limit = $?) in cash reserves

☐ Negotiate concessions/repairs where premiums are impacted

Bottom Line

In Florida, the real lever isn’t only price per square foot—it’s risk per month. Flood zone, elevation, roof profile, and wind-mit credits can shift your True Monthly by hundreds of dollars and change your peace of mind during storm season. Price them up front, and you’ll buy like a local.

Want me to run a True Monthly side-by-side for your favorite Tampa Bay homes (wind/flood quotes, roof checks, SIRS status for condos, and homestead-adjusted taxes)? I’ll package it so your first offer is your best one.

Fernanda Stucken — Tampa Bay Realtor

📧 contact@fernandastucken.com | 📞 (347) 216-6620

This article is educational, not legal/insurance advice. Always consult a licensed Florida insurance agent for quotes and coverage specifics.