Moving to Tampa from New York: Cost of Living, Taxes & Commute (SunPass vs. NYC)

Trading subway swipes for sunshine? If you’re moving to Tampa from NYC, the biggest day-to-day changes show up in your housing costs, taxes, and commute math. Here’s a practical guide to price your true monthly, switch residency the right way, and understand SunPass vs. NYC driving costs—without surprises.

Cost of Living: What Actually Drops (and what doesn’t)

Housing

More space for the money: South Tampa, Westchase, and Carrollwood often deliver extra bedrooms, a yard, and parking for what a smaller NYC place costs.

Condo vs. single-family: Condos carry HOA/condo dues (and for 3-story+ condos, Florida now requires strong structural reserves). Single-family homes avoid condo reserves but bring full homeowners insurance.

Insurance

Home insurance: Wind/hurricane risk is priced into Florida premiums. Lower costs are possible with a newer roof, hip roof shape, and wind-mitigation credits.

Flood insurance: Required in higher-risk zones (AE/VE). Many Tampa homes sit in X zones where flood is optional—and relatively inexpensive.

Groceries, dining, services

Generally lower than Manhattan/Brooklyn. Upscale dining exists (Hyde Park, Water Street), but everyday costs are more forgiving.

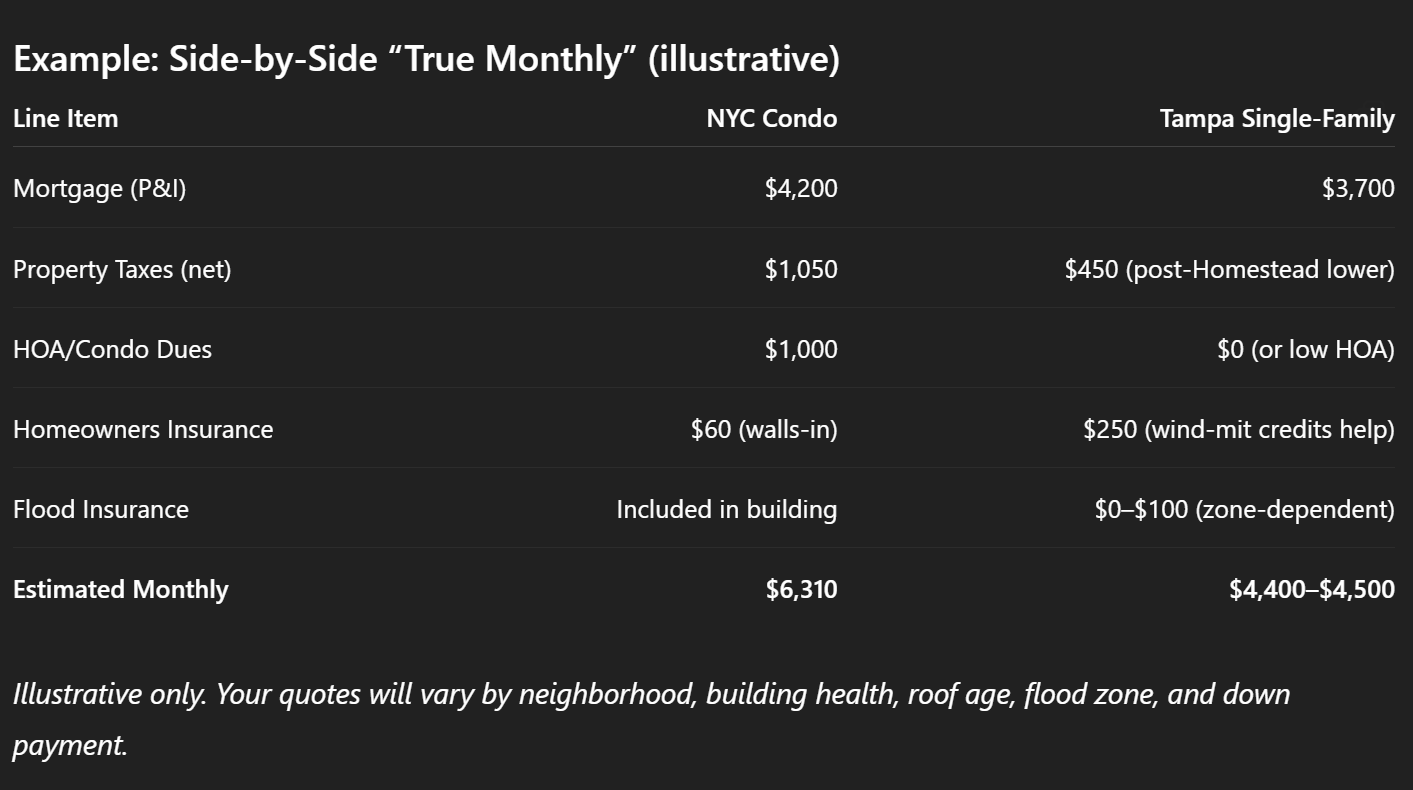

Your “True Monthly” (Florida-correct)

Mortgage (P&I) + Property taxes (with Homestead later) + Homeowners insurance + Flood (if any) + HOA/Condo dues (+ CDD if a master-planned community) = Real monthly you can bank on.

Taxes: Florida No State Income Tax (and how to make it stick)

The headline

Florida has no state income tax. That’s a real annual raise—especially for high earners and retirees drawing income.

Make Florida your tax home (cleanly)

Domicile moves first: Get a Florida driver license, register to vote, move your banking/medical, and file the Homestead Exemption on your primary residence (which also triggers the Save Our Homes cap on assessed value increases).

NY traps to avoid: If you keep a “permanent place of abode” in NY and spend too many days there, New York can still tax you as a resident. And if your job stays assigned to a NY office, NY may source your remote wages to NY under its “convenience” rule. The cleanest solution: switch your job assignment to Florida and keep day counts tidy.

Property taxes in Tampa

Once you Homestead, the Save Our Homes cap limits annual assessed-value increases (great long-term protection). If you sell and buy again in Florida, you can port part of that tax benefit to the next home.

Commute: SunPass vs. NYC (daily dollars & lifestyle)

NYC reality

Driving into core Manhattan stacks up tolls/fees fast, and parking is premium-priced. Many NYC commuters avoid driving altogether.

Tampa commute

Most residents drive; many routes use free interstates. Where toll roads exist, SunPass discounts keep per-mile costs modest.

Typical day: 15–30 road miles total for many neighborhoods (Westshore, Midtown, Downtown) with flexible non-toll options if you prefer.

Lifestyle upgrade

Door-to-door commutes with parking at home. Quick access to Bayshore Boulevard, the Riverwalk, and beaches on weekends.

Neighborhood Snapshots (where New Yorkers land)

Hyde Park / SoHo (South Tampa): Walkable, boutique dining, quick Downtown access; mix of historic homes, townhomes, and condos.

Davis Islands: Island vibe, marinas, golf-cart life, and waterfront estates; mind flood zone + elevation certificate.

Westchase / Carrollwood: Master-planned convenience, top parks and schools, single-family focus with fair commutes.

Water Street / Channelside / Harbour Island: Luxury condo towers, amenity-rich, minutes to the Riverwalk.

Smart Buyer Playbook (5 moves that save you money)

Price two insurances early: Get homeowners + flood quotes during inspection (share roof age, wind-mit, and EC if available).

Use local lenders/insurers: Tampa-based teams move faster and read buildings/neighborhoods correctly.

Write clean offers: Pre-underwritten approval, short timelines, and appraisal strategy win in in-demand zips.

Check association health (condos): Budget, reserves/SIRS compliance, insurance deductibles, and any special assessments.

Model your commute: Try a test run at rush hour; decide if a minor toll saves real time.

FAQs

Will I need flood insurance?

Only if the home is in a higher-risk zone or a lender requires it; many Tampa homes are in X zones where flood is optional (and inexpensive).

Can I keep a pied-à-terre in NYC?

Yes, but mind NY’s day count and “permanent place of abode” rules—or you risk NY residency taxation.

Is it hard to buy in South Tampa right now?

Well-priced homes still move quickly. Prep your financing and be ready to tour the day a listing hits.

Ready to Compare Homes & True Monthly Side-by-Side?

I’ll build you a custom shortlist with insurance quotes (wind/flood), Homestead-adjusted taxes, HOA/condo health, and commute maps—so your first Tampa offer is your best one.

Contact Fernanda Stucken — Tampa Bay Realtor

📧 contact@fernandastucken.com | 📞 (347) 216-6620

This article is educational—not legal/tax advice. Consult a CPA or attorney about residency and taxes

Keywords: moving to tampa from nyc, tampa cost of living, florida no state income tax, tampa commute